According to Statistics Canada, over half of young adults aged 25 to 44 report that rising costs are significantly affecting their ability to meet daily expenses. At TRU, some students are finding ways to adapt to these financial challenges, adjusting budgets and exploring additional income sources. In recent discussions, students shared their methods of managing increased expenses — from adjusting budgets to exploring additional sources of income. The Omega spoke to students to examine their strategies and gain insights into how students navigate their financial challenges in today’s economic environment.

Omega: Do you work while studying? If yes, how do you balance work and school?

Levi Escobar (LE): “I’m working while studying. It’s been extremely difficult for me to balance my work and education, but I rely on my support system and good planning to help reduce the stress.”

Terrence Ngari (TN): “Yes, I do. Personally, I try to focus on my main goal, which is my academics. I try my best to inform my employer of the times I’m available [and] the times I don’t have a class or exams to study for. At the same time, I don’t get carried away with what I earn; rather, I look at the bigger goal in my life, which is my studies. I know I have bigger dreams of pursuing my career, which I believe [will] at some point give me even more income. It’s just a matter of knowing your goals and priorities and looking at the bigger picture because if I end up putting work as my first priority, I might end up dropping out of school.”

Marvellous Ifezue (MI): “Yes, I’m working. I barely have time to take breaks. I typically try [submitting] assignments and other things on time so they don’t clash with work.”

Ruvimbo Marondera (RM): “I am not working at the present moment, but busy job hunting.”

Omega: How has the cost of living crisis affected your daily life as a student?

LE: “Cost of living has impacted my daily life immensely, and I’ve been forced to calculate my daily spending and budget accordingly.”

TN: “It has made me consider other options, such as looking for a cheaper place to stay because my previous place was very costly as the [rental market] was skyrocketing. It has also forced me to look for other online side hustles that can earn me some income.”

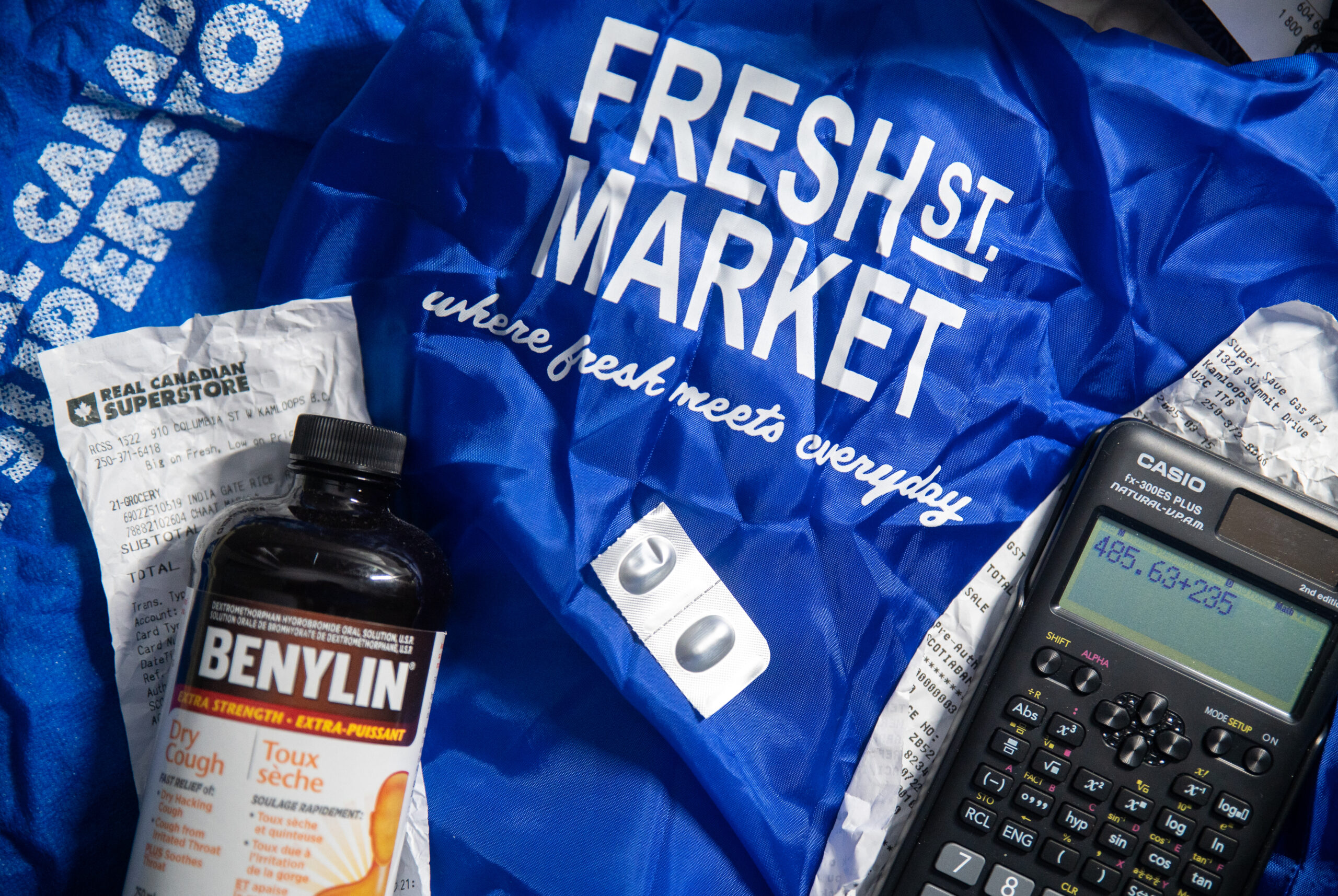

MI: “Cost of living is way too high, even as someone making a decent amount, it makes me scavenge for the best deals and coupons, and just settle for lesser quality items or food sometimes.”

RM: “It is really difficult keeping up with the price increases, especially when one has not found employment yet. I don’t randomly go to the supermarket anymore unless I really need something.”

Omega: Have you had to make any changes to your spending habits? If so, what?

LE: “I’ve had to reduce my food spending and cancel my gym membership because the economy has gotten significantly worse.”

TN: “I have to reconsider what I buy in the store. I don’t buy what I don’t need as I used to. For instance, I don’t buy groceries or items, electronics, etc, that I don’t need. Another instance is that I don’t see the [appeal] of buying a car right now since I live on-campus and I know maintaining a car is costly. I also try my best to avoid failing courses in school because that will financially drain me since tuition fees [are] quite costly for international students.”

MI: “I typically used to be able to save money, but now I’m unable to.”

RM: “I hardly buy coffee anymore because I realised it’s a hidden expense that costs me a bit. I buy my groceries in bulk to avoid frequent visits to the supermarket and overspending. I now hardly buy takeaways. I make a budget of what I need. If things go up and the budget is not enough, I make do. I write a list before leaving home so I don’t overspend.”

Omega: How do you feel about the availability of financial support (e.g., scholarships, bursaries, student loans) at TRU?

LE: “As a domestic student, I think I’m in a more favourable position to receive financial assistance. Unfortunately, I don’t believe that international students are being adequately served, especially given the high tuition TRU charges them.”

TN: “I’m not sure, but I can say that they are not highly available or, rather, they’re unpopular or scarce. We all know a number of students in TRU tend to live on their part-time jobs, which cater for their tuition fees. Others depend on their parents or guardians to sort out their tuition fees. I think TRU needs to seriously work on that.”

MI: “Although TRU has some financial support available, it doesn’t ease the burden on international student tuition, coming from someone who has gotten two scholarships.”

RM: “I feel that would be a great way to lift the cost of living crisis off the shoulders of the students, and it will give us peace of mind.”

As living costs rise, TRU students are rethinking their spending and work strategies. However, financial support varies, with international students often encountering more barriers due to higher tuition rates and fewer funding options.

How is the cost of living crisis affecting you? We want to hear from you! Send your thoughts to editor@theomega.news with the subject line “Letter to the Editor.”